UPI QR Code Central Bank Digital Currency

Context

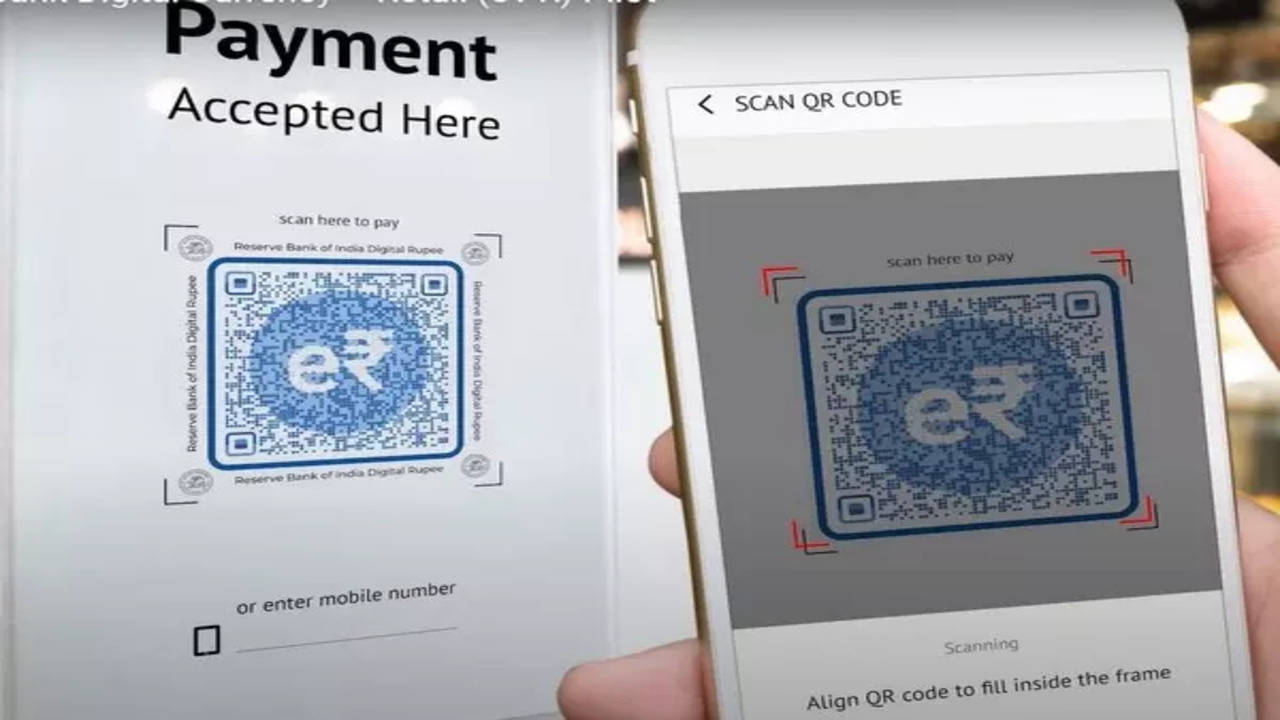

- With banks enabling the interoperability of Unified Payments Interface’s (UPI) Quick Response (QR) code with their central bank digital currency (CBDC) or e₹ application, users of retail digital rupee will be able to make transactions by scanning any UPI QR at a merchant outlet.

- Merchants can also accept digital rupee payments through their existing UPI QR codes.

- This integration of UPI and CBDC is part of the Reserve Bank of India’s (RBI) ongoing pilot project on pushing the retail digital rupee (e₹-R).

So, what is interoperability?

- Interoperability is the technical compatibility that enables a payment system to be used in conjunction with other payment systems, according to the RBI.

- Interoperability allows system providers and participants in different systems to undertake, clear and settle payment transactions across systems without participating in multiple systems.

Photo Credit: Times of India - Interoperability between payment systems contributes to achieving adoption, co-existence, innovation, and efficiency for end users.

And what is UPI QR code-CBDC interoperability?

- Interoperability of UPI with the digital rupee means all UPI QR codes are compatible with CBDC apps.

- Initially, when the pilot for the retail digital rupee was launched, the e₹-R users had to scan a specific QR code to undertake transactions.

- However, with the interoperability of the two, payments can be made using a single QR code.

- The digital rupee issued by the RBI, or the CBDC, is a tokenised digital version of the rupee.

- The e₹ is held in a digital wallet, which is linked to a customer’s existing savings bank account.

- UPI is directly linked to a customer’s account.

How will it benefit customers and merchants?

- The interoperability of UPI and CBDC will ensure seamless transactions between a customer and merchant without having the need to switch between multiple digital platforms.

- It will allow a digital rupee user to make payments for their daily needs, such as groceries and medicines, by scanning any UPI QR codes at any merchant outlet.

- Even merchants are not required to keep a separate QR code to accept the digital rupee payments.

- They can accept CBDC payments on their existing QR code.

What is a QR code?

- A Quick Response (QR) code consists of black squares arranged in a square grid on a white background, which can be read by an imaging device such as a camera.

- It contains information about the item to which it is attached, according to the National Payments Corporation of India (NPCI).

- QR code is an alternate contactless channel of payments.

- It allows merchants or businesses to accept payments from their customers directly into their bank accounts.

Source: IE

Visit Abhiyan PEDIA (One of the Most Followed / Recommended) for UPSC Revisions: Click Here

IAS Abhiyan is now on Telegram: Click on the Below link to Join our Channels to stay Updated

IAS Abhiyan Official: Click Here to Join

For UPSC Mains Value Edition (Facts, Quotes, Best Practices, Case Studies): Click Here to Join