Budgetary Procedure in Parliament

In India, the Union Budget is prepared by the Department of Economic Affairs of the Ministry of Finance. Earlier the budget was presented in two categories i.e. Railway budget and General budget, but now there will be no separate budget for Indian Railway which has been “merged” with the General Budget (in August 2016).

Budget

The Constitution refers to the budget as the ‘annual financial statement’. In other words, the term ‘budget’ has nowhere been used in the Constitution. It is the popular name for the ‘annual financial statement’ that has been dealt with in Article 112 of the Constitution.

Budget is a money bill introduced in Lok Sabha.

- According to Article 112 of the Indian Constitution, the President is responsible for presenting the budget to the Lok Sabha. The annual financial statement takes into account a period of one financial year.

- According to Article 77 (3), the Union Finance Minister has been made responsible by the President to prepare the budget also called the annual financial statement, and pilot it through the parliament. Budget embodies the estimated receipts and expenditure of the Government of India for one financial year. The financial year commences on 1st April each year.

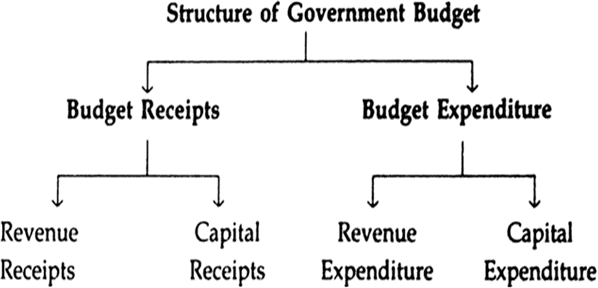

The Union Budget is divided into Revenue Budget and Capital Budget.

- Revenue Receipt:

- The receipts received which cannot be recovered by the government

- It comprises income amassed by the Government through taxes and non-tax sources like interest, dividends on investments.

- Revenue Expenditure:

- Expenditure incurred by the Union Government for purposes other than for the creation of physical or financial assets.

- It includes those expenditures incurred for the usual functioning of the government departments, grants given to state governments and interest payments on the debt of the Union Government, etc.

- Capital Receipt:

- Receipts which generate liability or decrease the financial assets of the government

- It includes borrowings from the Reserve Bank of India and commercial banks and other financial institutions

- It also consists of loans received from foreign governments and international organization and repayment of loans granted by the Union government

- Capital Expenditure:

- Spending incurred by the government which results in the formation of physical or financial possessions of the Union government or decrease in financial liabilities of the Union Government.

- It contains expenditure on procuring land, equipment, infrastructure, expenditure in shares.

- It also includes mortgages by the Union government to Public Sector Undertakings, state and union territories

Constitutional Provisions

The Constitution of India contains the following provisions with regard to the enactment of budget:

- The President shall in respect of every financial year cause to be laid before both the Houses of Parliament a statement of estimated receipts and expenditure of the Government of India for that year.

- No demand for a grant shall be made except on the recommendation of the President.

- No money shall be withdrawn from the Consolidated Fund of India except under appropriation made by law.

- No money bill imposing the tax shall be introduced in the Parliament except on the recommendation of the President, and such a bill shall not be introduced in the Rajya Sabha.

- No tax shall be levied or collected except by authority of law.

- Parliament can reduce or abolish a tax but cannot increase it.

- The Constitution has also defined the relative roles or position of both the Houses of Parliament with regard to the enactment of the budget in the following way:

- A money bill or finance bill dealing with taxation cannot be introduced in the Rajya Sabha—it must be introduced only in the Lok Sabha.

- The Rajya Sabha has no power to vote on the demand for grants; it is the exclusive privilege of the Lok Sabha.

- The Rajya Sabha should return the Money bill (or Finance bill) to the Lok Sabha within fourteen days. The Lok Sabha can either accept or reject the recommendations made by Rajya Sabha in this regard.

- The estimates of expenditure embodied in the budget shall show separately the expenditure charged on the Consolidated Fund of India and the expenditure made (Votable) from the Consolidated Fund of India.

- The budget shall distinguish expenditure on revenue account from other expenditure.

- The expenditure charged (Non-votable) on the Consolidated Fund of India shall not be submitted to the vote of Parliament. However, it can be discussed by Parliament.

Charged Expenditure

- In India’s democratic system, the government cannot spend from the Consolidated Fund unless the expenditure is voted in the lower house of Parliament or State Assemblies. However, according to Article 112 (3) and Article 202 (3) of the Constitution of India, the following expenditure does not require a vote and is charged to the Consolidated Fund.

- The following expenses are charged on the Consolidated Fund of India:

- President’s Emoluments and allowances and other expenditure relating to his office

- Chairman and the Deputy Chairman of the Rajya Sabha and the Speaker and the Deputy Speaker of the Lok Sabha – Salaries and allowances

- Salaries, allowances, and pensions of the Supreme Court’s judges

- Pensions of the High Courts’ judges

- Comptroller and Auditor General of India’s salaries, allowances, and pensions

- Salaries, allowances, and pension of the chairman and members of the Union Public Service Commission

- Administrative expenses of the Supreme Court, the office of the Comptroller and Auditor General of India, and the Union Public Service Commission including the salaries, allowances, and pensions of the persons serving in these offices

- The debt charges for which the Government of India is liable, including interest, sinking fund charges, and redemption charges, and other expenditure relating to the raising of loans and the service and redemption of debt

- Any sum required to satisfy any judgment, decree, or award of any court or arbitral tribunal

- Any other expenditure declared by the Parliament to be so charged

Budgetary Procedure – Enactments of Budget in the Parliament

It is also called as ‘enactments of budget’ which means converting the two bills into acts. The passage in Parliament has five stages:

- Presentation of the budget with the Finance Minister’s speech

- General discussion of the budget. After this, there is an adjournment of houses so that standing committees scrutinize the demand for grants for a month.

- Voting on demand for grants in Lok Sabha

- Passing of appropriation bills

- Passing of Finance bills.

Article 112 of the Constitution enjoins upon the President of India to get the budget presented before both of the houses of Parliament. Being a Money Bill, it has to be presented to the Lok Sabha first and must classify the charge on the Consolidated Fund and expenditure on the Consolidated Fund of India separately.

- There is a prescribed legislative procedure in each house and the Rajya Sabha should not delay it for more than fourteen days. The Consolidated Fund, Contingency Fund, and public account transactions are updated to appraise the Parliament which operates the Consolidated Fund at the President’s disposal and takes stock of public account assets and liabilities without voting on them. The budget in India had to pass through three readings without any committee stage.

1. Budget Presentation

The first reading is called the presentation of the budget which includes the following documents:

- The economic survey report,

- Economic classification of the budget,

- Annual reports of the ministries,

- An explanatory memorandum on the budget,

- An Appropriation Bill, and

- A Finance Bill containing the taxation proposals.

The Budget is presented on 1st February (until 2016, it was presented on the last working day of February) so that it can materialize before the commencement of the new financial year which starts on 1st April. The finance minister presents the General Budget with a speech known as the ‘budget speech’. At the end of the budget speech in the Lok Sabha, the budget is laid before the Rajya Sabha which can only discuss it and has no power to vote on the demand for grants.

2. General Discussion

- The general discussion on a budget takes place during the budget session. It lasts for three to four days. During this stage, the Lok Sabha can discuss the budget as a whole or on any question of principle involved therein but no motion is moved or submitted for the vote of the House. The finance minister has a right to reply at the end of the discussion. After the general discussion on budget, the Lok Sabha takes upvoting of demands for grants.

Scrutiny by Departmental Committees

- After the general discussion on the budget is over, the Houses are adjourned for about three to four weeks. During this gap period, the 24 departmental standing committees of Parliament examine and discuss in detail the demands for grants of the concerned ministers and prepare reports on them. These reports are submitted to both the Houses of Parliament for consideration.

3. Voting on Demands for Grants

- They are presented ministry-wise and demand becomes a grant after it has been voted. The voting of demands for grants is the exclusive privilege of the Lok Sabha and not of Rajya Sabha. The voting is confined to the votable part of the budget but the expenditure charged on the Consolidated Fund of India can only be discussed.

- The General Budget has totally of 109 demands (103 for civil expenditure and 6 for defense expenditure), the Railway Budget has 32 demands. Each demand is voted separately by the Lok Sabha. During this stage, the members of Parliament can discuss the details of the budget. They can also move to reduce any demand for grants. But increase or upward revisions of estimates are not permissible.

- The members who propose a reduction of grant bring three kinds of cut motions which are either withdrawn or dropped because their passing will be tantamount to a vote of no confidence in the government. Still, to attract the attention of the government, the cut motions are moved to bring moral pressure on the executive.

These cut motions are:

(1) Token Cut Motion: It expresses a specific grievance that is within the sphere of responsibility of the government. It states that the amount of the demand be reduced by Rs 100. On the 26th day, the Speaker puts all the remaining demands to vote and disposes of them whether they have been discussed by the members or not. This is called as ‘Guillotine closer’.

(2) Policy Cut Motion shows disapproval of the policy underlying a demand. It states that the amount of the demand be reduced to Re 1.

(3) Economy Cut Motion asks for the economy in the proposed expenditure. It states that the amount of the demand be reduced by a specified amount which may be either a lump-sum reduction or omission or reduction of an item in the demand.

Article 113 and 114 provide for the presentation of various kinds of demands for grants by the Parliament. Some of them are:

(1) Vote on credit

- It is granted for meeting an unexpected demand upon the resources of India when on account of the magnitude or the indefinite character of the service, the demand cannot be stated with the details ordinarily given in a budget. Hence, it is like a blank cheque given to the Executive by the Lok Sabha.

(2) Vote on accounts

- Vote on Account is a grant in advance to enable the government to carry on until the voting of demands for grants and the passing of the Appropriation Bill and Finance Bill.

(3) Vote on exceptional grants

- It is granted for a special purpose and forms no part of the current service of any financial year.

(4) Supplementary grants

- It is granted when the amount authorized by the Parliament through the appropriation act for a particular service for the current financial year is found to be insufficient for that year.

(5) Excess grants

- It is granted when money has been spent on any service during a financial year in excess of the amount granted for that service in the budget for that year. It is voted by the Lok Sabha after the financial year. Before the demands for excess grants are submitted to the Lok Sabha for voting, they must be approved by the Public Accounts Committee of Parliament.

(6) Token grants

- It is granted when funds to meet the proposed expenditure on a new service can be made available by reappropriation. Demand for the grant of a token sum (of Re 1) is submitted to the vote of the Lok Sabha and if assented, funds are made available. Reappropriation involves the transfer of funds from one head to another. It does not involve any additional expenditure.

In addition to the budget, various other kinds of grants are made by the Parliament under extraordinary or special circumstances. When the amount authorized by the Parliament through the Appropriation Act for a particular service for the current financial year is found to be insufficient for the purposes of that year supplementary grants are sanctioned by the Parliament.

Similarly, when a need has arisen during the current financial year for additional expenditure upon some new service not contemplated in the budget, Parliament may consider additional grants. Excess grants are given when money has been spent on any service during a financial year in excess of the amount granted for that service in the budget for that year.

It is voted by the Lok Sabha after the financial year. Only, if approved by the Public Accounts Committee to meet an unexpected demand upon resources and if the account is huge or of indefinite character, the vote on credit is resorted to like a blank cheque given to the executive by the Lok Sabha.

For special purposes that form no part of the current service of any financial year, exceptional grants can be made. Parliament makes token grants available if funds to meet the proposed expenditure on a new service are available by re-appropriation. Demand for the grant of a token sum (of Re 1) is submitted to the vote of the Lok Sabha and if assented, funds follow. Supplementary, additional, excess, and exceptional grants and vote of credit are regulated by the same procedure which is applicable in the case of a regular budget.

4. Passing of Appropriation Bill

- The Appropriation Bill and Finance Bill after the debate is put to vote on the floor of the Parliament sequentially. The Appropriation Bill comes first and then the Finance Bill has to make revenue provisions for the stipulated expenditure sanctioned by the Parliament. No amendment can be proposed to the Appropriation Bill in either house of the Parliament which will have the effect of varying the amount or altering the destination of any grant voted.

- The Appropriation Bill becomes the Appropriation Act after it is assented to by the President. This Act authorizes the payments from the Consolidated Fund of India. If the government needs money to carry on its normal activities after 31st March, the Constitution authorizes the Lok Sabha to make a grant in advance in respect to the estimated expenditure for a part of the financial year, pending the enactment of the Appropriation Bill. This ‘Vote on Account’ is passed after a general discussion on budget and is generally granted for two months for an amount equivalent to one-sixth of the total estimation.

5. Passing of Finance Bill

- The Finance Bill when passed legalizes the income side of the budget. According to the Provisional Collection of Taxes Act 1931, the Finance Bill in India has to be passed within 75 days. The bill gives effect to supplementary financial proposals for any period.

- It is a money bill for procedural purposes and unlike the Appropriation Bill, the members can move amendments to reject or reduce a tax in a prescribed manner. The proposals for new taxation require the previous consent of the President before the presentation.

Indian Polity Notes: Click Here

For Other Subject Wise Prelims Revisions: Click Here

For IAS Abhiyan NCERT Notes / Current Affairs / Test Series / Standard Notes : Click here