Delays in insolvency resolution

Context

-

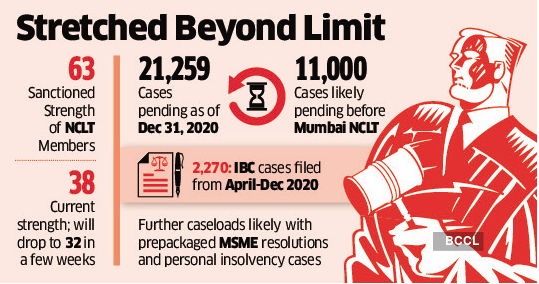

Recently, the Parliamentary Standing Committee on Finance has called out the Ministry of Corporate Affairs on prolonged vacancies in National Company Law Tribunals (NCLTs) resulting in delays in corporate insolvency under the Insolvency and Bankruptcy Code (IBC).

-

Earlier, the union government presented the Insolvency and Bankruptcy Code (Amendment Bill), 2021 in the Lok Sabha which introduces an alternative insolvency resolution process for Micro, Small and Medium Enterprises (MSMEs) called the Pre-packaged Insolvency Resolution Process (PIRP).

Why Vacancies in NCLT is a huge problem?

- The collective strength of the current NCLT benches around the country at present is only 29 members against the total authorized strength of 63 members.

- The panel observed that delays in the admission of insolvency cases by NCLTs and the approval of resolution plans were the vital reasons behind the non-compliance of timelines under the IBC.

Source : Economic Times - These delays by NCLT in admitting cases gave defaulting owners the chance to divert funds and transfer assets.

- A number of prominent cases under the IBC saw many decisions being challenged by parties involved. Many of these appeals are frivolous attempts to hold back insolvency proceedings.

- Cases in which creditors have evaluated resolution plans submitted after the specified deadline would discourage bidders from bidding within set timelines and that such plans also contribute to delays and value destruction.

Key recommendations by the committee

- To avoid any delays, NCLT should be required to admit a defaulting company into insolvency proceedings and hand over control to a resolution professional within 30 days.

- The MCA, as the nodal ministry, should take bigger responsibility to rationalize the operational processes in NCLT/National Company Law Appellate Tribunal (NCLAT) while continuously monitoring and analysing the workflow, disposal and outcomes with respect to resolutions, recoveries, time taken, etc.

- The panel also suggested that the IBC be amended to provide micro, small and medium enterprises (MSMEs), which are operational creditors under the IBC, with better protection in the existing economic environment.

- The IBC currently prioritises financial creditors over operational creditors.

- Financial creditors are those whose relationship with the entity is a pure financial contract, such as a loan or a debt security.

- Operational creditors are those whose liability from the entity comes from a transaction on operations.

Back to Basics

About National Company Law Tribunal

- It is a quasi-judicial body in that adjudicates issues relating to Indian companies.

- The Union Government constituted National Company Law Tribunal (NCLT) under the Companies Act, 2013 in 2013 and is based on the recommendation of the V. Balakrishna Eradi committee on law relating to the insolvency and the winding up of companies.

- It combines all powers to oversee the companies registered in India.

- All proceedings under the Companies Act, including proceedings relating to arbitration, compromise, arrangements, reconstructions and the winding up of companies shall be disposed off by the National Company Law Tribunal.

- The NCLT is the adjudicating authority for the insolvency resolution procedure of companies and limited liability partnerships under the Insolvency and Bankruptcy Code, 2016.

- The NCLT bench is presided by a Judicial member who is supposed to be a retired or a serving High Court Judge and a Technical member who must be from the Indian Corporate Law Service, ICLS Cadre.

- With the establishment of the NCLT and NCLAT, the Company Law Board under the Companies Act, 1956 has now been dissolved.

- It is bound by the rules laid down in the Code of Civil Procedure and is guided by the principles of natural justice, subject to the other provisions of this Act and of any rules that are made by the union Government.

- Appeal from order of Tribunal can be raised to the National Company Law Appellate Tribunal (NCLAT).

- Appeals can be made by any person aggrieved by an order or decision of the NCLT, within a period of 45 days from the date on which a copy of the order or decision of the Tribunal is received by the Appellant.

- Any person aggrieved by any order of the NCLAT may file an appeal to the Supreme Court.

Economy Current Affairs : Click Here