Context

- The Covid-19 pandemic has left its impact on all sectors of the economy but nowhere is the hurt as much as the Medium, Small and Micro Enterprises (MSMEs) of India.

How are MSMEs defined?

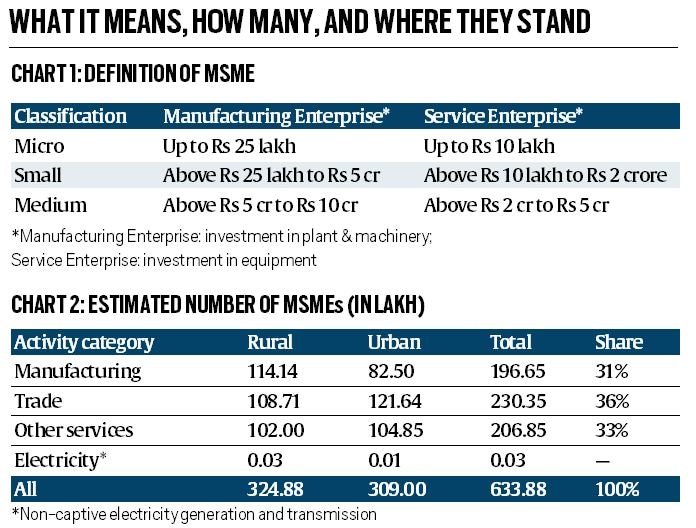

- Formally, MSMEs are defined in terms of investment in plant and machinery (Chart 1). But this criterion for the definition was long criticised because credible and precise details of investments were not easily available by authorities.

- That is why in February 2018, the Union Cabinet decided to change the criterion to “annual turnover”, which was more in line with the imposition of GST.

- According to the proposed definition, which is yet to be formally accepted, a micro enterprise will be one with an annual turnover less than Rs 5 crore; a small enterprise with turnover between Rs 5 crore and Rs 75 crore; and a medium enterprise with turnover less than Rs 250 crore.

How many MSMEs does India have, who owns them, and where are they situated?

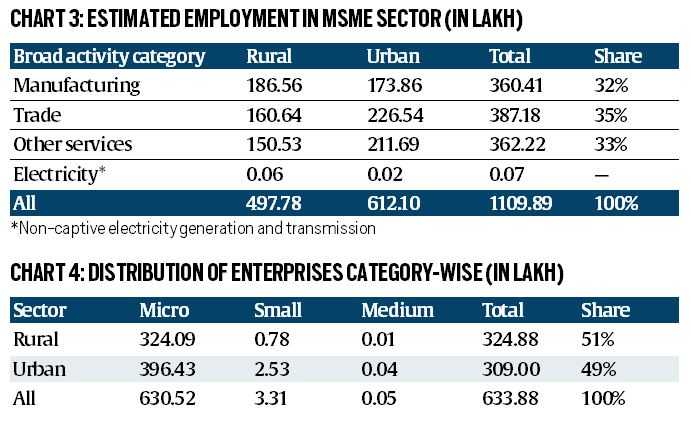

- According to the latest available (2018-19) Annual Report of Department of MSMEs, there are 6.34 crore MSMEs in the country (Chart 2). Around 51 per cent of these are situated in rural India. Together, they employ a little over 11 crore people (Chart 3) but 55 per cent of the employment happens in the urban MSMEs.

- These numbers suggest that, on average, less than two people are employed per MSME. At one level that gives a picture of how small these really are. But a breakup of all MSMEs into micro, small and medium categories is even more revealing.

- As Chart 4 shows, 99.5 per cent of all MSMEs fall in the micro category.

- While micro enterprises are equally distributed over rural and urban India, small and medium ones are predominantly in urban India. In other words, micro enterprises essentially refer to a single man or a woman working on their own from their home.

- The medium and small enterprises — that is, the remaining 0.5% of all MSMEs — employ the remaining 5 crore-odd employees.

- The distribution of enterprise by caste further completes the picture. About 66 per cent of all MSMEs are owned by people belonging to the Scheduled Castes (12.5%), the Scheduled Tribes (4.1%) and Other Backward Classes (49.7%). The gender ratio among employees is largely consistent across the board at roughly 80% male and 20% female.

- In terms of geographical distribution, seven Indian states alone account for 50 per cent of all MSMEs. These are Uttar Pradesh (14%), West Bengal (14%), Tamil Nadu (8%), Maharashtra (8%), Karnataka (6%), Bihar (5%) and Andhra Pradesh (5%).

What kind of problems do MSMEs in India face?

- Given the shape and form of MSMEs, it is not hard to envisage the kind of problems they would face.

- To begin with, most of them are not registered anywhere.

- A big reason for this is that they are just too small. Even GST has its threshold and most micro enterprises do not qualify.

- This apparent invisibility tends to work for enterprises as well as against them. Being out of the formal network, they do not have to maintain accounts, pay taxes or adhere to regulatory norms etc. This brings down their costs.

- But, as it is clear in a time of crisis, it also constrains a government’s ability to help them. For instance, in some of developed countries, the government has tried to directly provide wage subsidy and extra credit to smaller firms but that could happen because even smaller firms were being mapped.

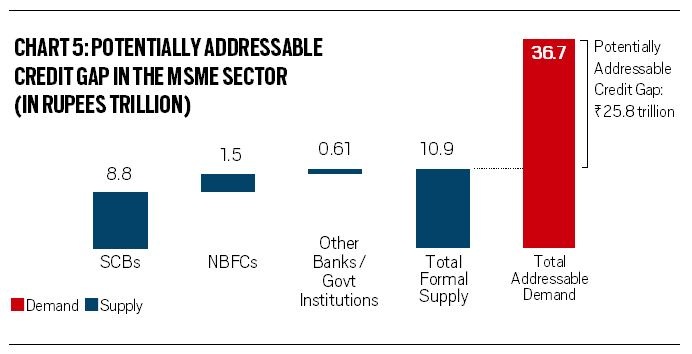

- Related to this is possibly the single-biggest hurdle facing the MSMEs – lack of financing. According to a 2018 report by the International Finance Corporation (part of the World Bank), the formal banking system supplies less than one-third (or about Rs 11 lakh crore) of the credit MSME credit need that it can potentially fund (Chart 5).

- In other words, most of the MSME funding comes from informal sources and this fact is crucial because it explains why the Reserve Bank of India’s efforts to push more liquidity towards the MSMEs have had a limited impact.

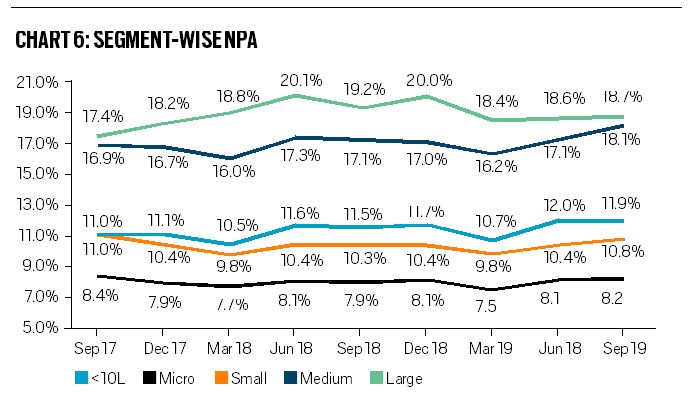

- A key reason why banks dither from extending loans to MSMEs is the high ratio of bad loans (Chart 6); data show higher slippage for relatively bigger enterprises.

- The other big issue plaguing the sector is the delays in payments to MSMEs — be it from their buyers (which includes the government also) or things like GST refunds etc.

What can be done?

- The RBI has been trying to pump money into the MSME sector but given the structural constraints, it has had limited impact. Hetal Gandhi, Director, CRISIL, believes that there are no easy answers.

- The government can provide tax relief (GST and corporate tax), give swifter refunds, and provide liquidity to rural India (say, through PM-Kisan) to boost demand for MSME products, she said.

What about credit guarantees?

- Loans to MSMEs are mostly given against property (as collateral) — because often there isn’t a robust cash flow analysis available — but in times of crisis, property values fall and that inhibits the extension of new loans.

- A credit guarantee by the government helps as it assures the bank that its loan will be repaid by the government in case the MSME falters. To the extent such defaults happen, credit guarantees are shown as a departmental expense in the Budget.

Source: Indian Express