Context

-

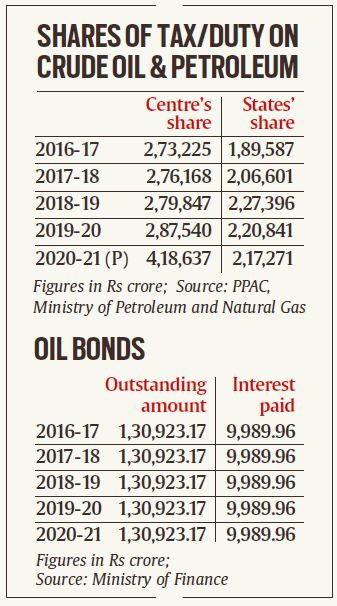

The Finance Minister has said the government cannot bring down taxes – and thus oil prices – because it has to pay for oil bonds issued by the UPA.

How much of fuel prices is tax?

- There are two components to the domestic retail price — the price of crude oil itself, and the taxes levied on this basic price. Together they make up the retail price.

Credit: Indian Express - The taxes vary from one product to another.

- For instance, as of now, taxes account for 50% of the total retail price for a litre of petrol, and 44% for a litre of diesel.

What are oil bonds? Why were they issued?

- When fuel prices were too high for domestic consumers, governments in the past often asked oil marketing companies (OMCs) to avoid charging consumers the full price.

- But if oil companies don’t get paid, they would become unprofitable. To address this, the government said it would pay the difference. But again, if the government paid that amount in cash, it would have been pointless, because then the government would have had to tax the same people to collect the money to pay the OMCs.

- This is where oil bonds come in.

- An oil bond is an IOU, or a promissory note issued by the government to the OMCs, in lieu of cash that the government would have given them so that these companies don’t charge the public the full price of fuel.

- By issuing such oil bonds, the government of the day is able to protect/ subsidise the consumers without either ruining the profitability of the OMC or running a huge budget deficit itself.

- There are two components of oil bonds that need to be paid off:

- the annual interest payment, and

- the final payment at the end of the bond’s tenure.

- By issuing such bonds, a government can defer the full payment by 5 or 10 or 20 years, and in the interim just pay the interest costs.

Reference:

https://indianexpress.com/article/explained/the-economics-of-oil-bonds-russia-ukraine-war-7871329/

Visit Abhiyan PEDIA (One of the Most Followed / Recommended) for UPSC Revisions: Click Here

IAS Abhiyan is now on Telegram: Click on the Below link to Join our Channels to stay Updated

IAS Abhiyan Official: Click Here to Join

For UPSC Mains Value Edition (Facts, Quotes, Best Practices, Case Studies): Click Here to Join