Context :

- Recently the report of the Fifteenth FC, along with an Action Taken Report, was tabled in Parliament

About Fifteenth Finance Commission (FC)

- The Fifteenth Finance Commission (FC) has considered the 2011 population along with forest cover, tax effort, area of the state, and “demographic performance” to arrive at the states’ share in the divisible pool of taxes.

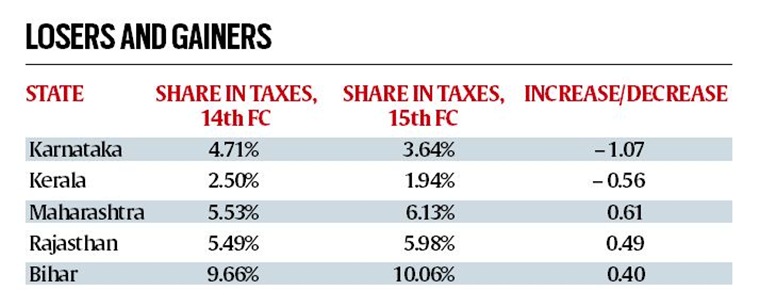

- As had been widely anticipated, shares of the southern states, except Tamil Nadu, have fallen — with Karnataka losing the most.

About Finance Commission

- The Finance Commission is a constitutionally mandated body that decides, among other things, the sharing of taxes between the Centre and the states.

- Article 280 (1) requires the President to constitute, “within two years from the commencement of this Constitution and thereafter at the expiration of every fifth year or at such earlier time as the President considers necessary

- FC shall consist of a Chairman and four other members

- Under Article 280(3)(a), the Commission must make recommendations to the President “as the distribution between the Union and the States of the net proceeds of taxes which are to be, or may be, divided between them under this Chapter and the allocation between the States of the respective shares of such proceeds”.

- Accordingly, the Commission determines a formula for tax-sharing between the states, which is a weighted sum of the states’ population, area, forest cover, tax capacity, tax effort and demographic performance, with the weights expressed in percentages. This crucial role of the Commission makes it instrumental in the implementation of fiscal federalism.

15th Finance Commission

- The report of the Fifteenth FC, along with an Action Taken Report, was tabled in Parliament

- The Commission has reduced the vertical devolution — the share of tax revenues that the Centre shares with the states — from 42% to 41%. The 1 per cent decrease in the vertical devolution is roughly equal to the share of the erstwhile state of Jammu and Kashmir, which would have been 0.85% as per the formula described by the Commission.

- The Commission has said that it intends to set up an expert group to initiate a non-lapsable fund for defence expenditure.

- The terms of reference of the Commission included considering the Centre’s demand for funds for defence and national security. It may do so by creating a separate fund from the gross tax revenue before computing the divisible pool — which means that states would get a smaller share of the taxes.

Population Parameter

- The population parameter used by the Commission has been criticised by the governments of the southern states.

- The previous FC used both the 1971 and the 2011 populations to calculate the states’ shares, giving greater weight to the 1971 population (17.5%) as compared to the 2011 population (10%). The Fifteenth FC has reasoned that the terms of reference leave it with no choice but to use the 2011 population; it has also argued that in the interest of fiscal equalisation, it is necessary to use the latest Census figures.

- The use of 2011 population figures has resulted in states with larger populations like Uttar Pradesh and Bihar getting larger shares, while smaller states with lower fertility rates (the number of children born to a woman in her life) have lost out.

- The combined population of the Hindi-speaking northern states (Bihar, Uttar Pradesh, Madhya Pradesh, Rajasthan and Jharkhand) is 47.8 crore. This is over 39.48% of India’s total population, and is spread over 32.4% of the country’s area, as per the 2011 Census. They also get a slightly more than the proportional share of the divisible pool of taxes (45.17%).

- On the other hand, the southern states of Tamil Nadu, Kerala, Karnataka and undivided Andhra Pradesh are home to only 20.75% of the population living in 19.34% of the area, with a 13.89% share of the taxes. This means that the terms decided by the Commission are loaded against the more progressive (and prosperous) southern states.

The demographic effort

- In order to reward population control efforts by states, the Commission developed a criterion for demographic effort — which is essentially the ratio of the state’s population in 1971 to its fertility rate in 2011 — with a weight of 12.5%. States such as Kerala, Tamil Nadu, Karnataka, Andhra Pradesh, and Telangana have fertility rates below the replacement rate, or the number of children that have to be born to a woman of reproductive age in order for the population to maintain itself at the current level without migration.

- However, the effect of the demographic effort in increasing states’ devolution is not clear. Shares of states like Maharashtra, Himachal Pradesh and Punjab, along with Tamil Nadu, all of which have fertility rates below the replacement level, have increased slightly. On the other hand, Andhra Pradesh, Kerala, Karnataka, and West Bengal’s shares have fallen, even though their fertility rates are also low.

- Incidentally, Karnataka, the biggest loser in this exercise, also had the highest tax-GSDP ratio in 2017-18, as per an RBI report on state finances. Tax effort was also used by the Commission to decide the states’ shares, with a weight of 2.5%.

Income distance criterion

- The total area of states, area under forest cover, and “income distance” were also used by the FC to arrive at the tax-sharing formula.

- Income distance is calculated as the difference between the per capita gross state domestic product (GSDP) of the state from that of the state with the highest per capita GSDP, with states with less income getting a higher share in order to allow them to provide services comparable to those provided by the richer ones.

- The Commission used the per capita GSDP of Haryana as the reference for calculating the income distance, and gave it a weight of 45%, down from the 50% assigned by the 14th FC. The weight assigned to state area was unchanged at 15%, and that of forest cover was increased from 7.5% to 10%.

Source:IE