Context

-

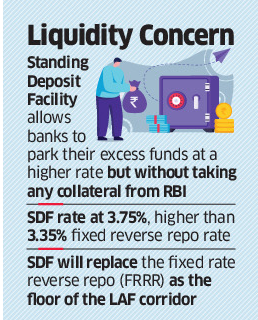

While retaining the reverse repo rate at 3.35 per cent, the Reserve Bank of India (RBI) introduced the Standing Deposit Facility (SDF), an additional tool for absorbing liquidity, at an interest rate of 3.75 per cent.

Role of Standing Deposit Facility (SDF)

- The main purpose is to reduce the excess liquidity of Rs 8.5 lakh crore in the system, and control inflation.

Credit: Economic Times - In 2018, the amended Section 17 of the RBI Act empowered the Reserve Bank to introduce the SDF – an additional tool for absorbing liquidity without any collateral. By removing the binding collateral constraint on the RBI, the SDF strengthens the operating framework of monetary policy. The SDF is also a financial stability tool in addition to its role in liquidity management.

- The SDF will replace the fixed rate reverse repo (FRRR) as the floor of the liquidity adjustment facility corridor.

- Both the standing facilities — the MSF (marginal standing facility) and the SDF will be available on all days of the week, throughout the year.

How it will operate

- The SDF rate will be 25 bps below the policy rate (Repo rate), and it will be applicable to overnight deposits at this stage.

- It would, however, retain the flexibility to absorb liquidity of longer tenors as and when the need arises, with appropriate pricing.

- The RBI’s plan is to restore the size of the liquidity surplus in the system to a level consistent with the prevailing stance of monetary policy.

Reverse repo rate

- The fixed rate reverse repo (FRRR) rate which is retained at 3.35 per cent will remain part of the RBI’s toolkit, and its operation will be at the discretion of the RBI for purposes specified from time to time.

- The FRRR along with the SDF will impart flexibility to the RBI’s liquidity management framework, the RBI said.

Question of liquidity

- The “extraordinary” liquidity measures undertaken in the wake of the pandemic, combined with the liquidity injected through various other operations of the RBI, have left a liquidity overhang of the order of Rs 8.5 lakh crore in the system.

- This has pushed up the retail inflation level in the system. The RBI will engage in a gradual and calibrated withdrawal of this liquidity over a multi-year time frame in a non-disruptive manner beginning this year.

The fixed rate reverse repo (FRRR)

- The FRRR rate, retained at 3.35%, will remain part of the RBI’s toolkit, and its operation will be at the discretion of the RBI for purposes specified from time to time.

- The FRRR along with the SDF will impart flexibility to the RBI’s liquidity management framework, the RBI said.

- The extraordinary liquidity measures undertaken in the wake of the pandemic, combined with the liquidity injected through various other operations of the RBI, have left a liquidity overhang of the order of Rs 8.5 lakh crore in the system

Visit Abhiyan PEDIA (One of the Most Followed / Recommended) for UPSC Revisions: Click Here

IAS Abhiyan is now on Telegram: Click on the Below link to Join our Channels to stay Updated

IAS Abhiyan Official: Click Here to Join

For UPSC Mains Value Edition (Facts, Quotes, Best Practices, Case Studies): Click Here to Join