Summary of Union Budget 2022-23

Context

- India’s economic growth in the current year is estimated to be 9.2 per cent, highest among all large economies.

- The overall, sharp rebound and recovery of the economy from the adverse effects of the pandemic is reflective of our country’s strong resilience. This was stated by Union Minister for Finance and Corporate Affairs while presenting the Union Budget in Parliament.

Summary of Union Budget 2022-23

- The Finance Minister said, India is celebrating Azadi ka Amrit Mahotsav and it has entered into Amrit Kaal, the 25-year-long leadup to India@100, the government aims to attain the vision of Prime Minister outlined in his Independence Day address and they are:

- Complementing the macro-economic level growth focus with a micro-economic level all-inclusive welfare focus,

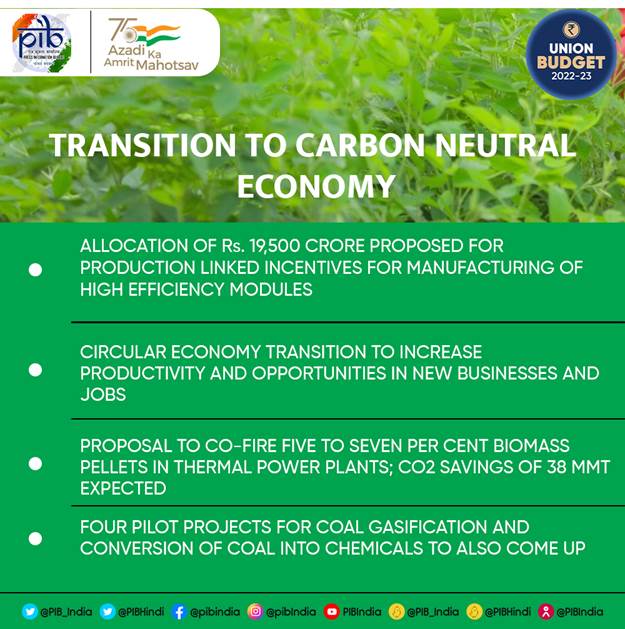

- Promoting digital economy & fintech, technology enabled development, energy transition, and climate action, and

- Relying on virtuous cycle starting from private investment with public capital investment helping to crowd-in private investment.

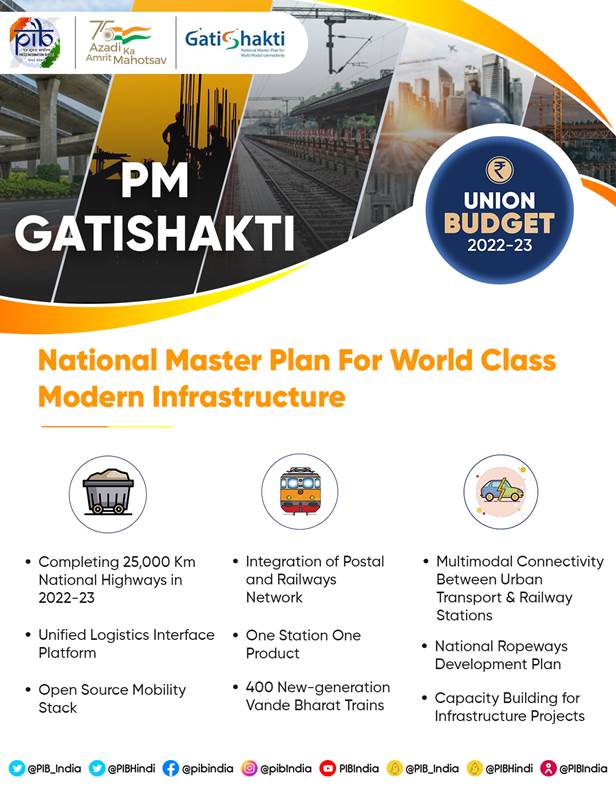

- Budget continues to provide impetus for growth. It lays a parallel track of (1) a blueprint for the Amrit Kaal, which is futuristic and inclusive, which will directly benefit our youth, women, farmers, the Scheduled Castes and the Scheduled Tribes. And (2) big public investment for modern infrastructure, readying for India at 100 and this shall be guided by PM GatiShakti and be benefited by the synergy of multi-modal approach. Moving forward, on this parallel track, She outlined the following four priorities:

- PM GatiShakti

- Inclusive Development

- Productivity Enhancement & Investment, Sunrise Opportunities, Energy Transition, and Climate Action

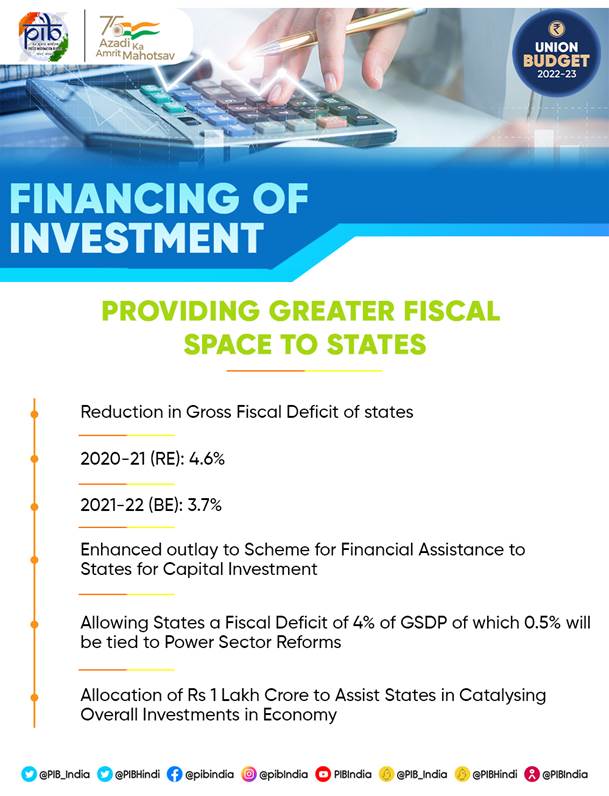

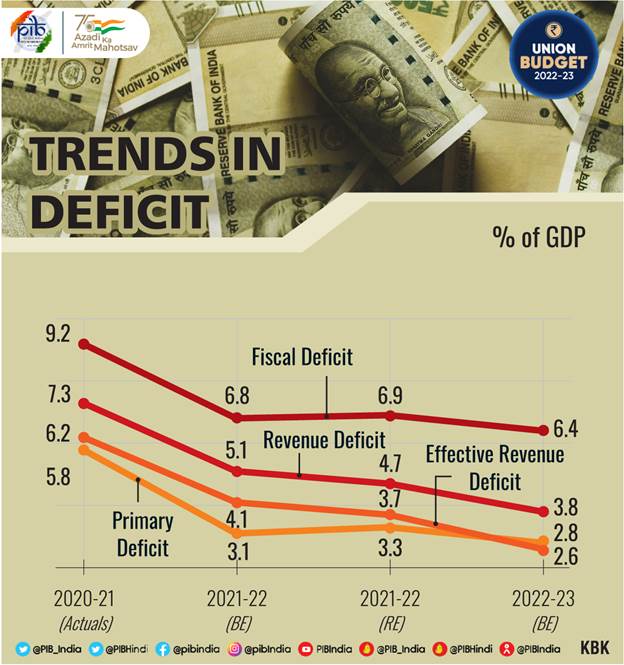

- Financing of Investments

- In Railways, the Finance Minister said that ‘One Station-One Product’ concept will be popularized to help local businesses & supply chains. Moreover, as a part of Atmanirbhar Bharat, 2,000 km of network will be brought under Kavach, the indigenous world-class technology for safety and capacity augmentation in 2022-23.

- On Agriculture front, the Finance Minister informed that Chemical-free Natural Farming will be promoted throughout the country, with a focus on farmers’ lands in 5-km wide corridors along river Ganga, at the first stage. Use of ‘Kisan Drones’ will be promoted for crop assessment, digitization of land records, spraying of insecticides, and nutrients. She said, to reduce dependence on import of oilseeds, a rationalised and comprehensive scheme to increase domestic production of oilseeds will be implemented.

- As 2023 has been announced as the International Year of Millets, the government announced full support for post-harvest value addition, enhancing domestic consumption, and for branding millet products nationally and internationally.

- Moreover, Draft DPRs of five river links, namely Damanganga-Pinjal, Par-TapiNarmada, Godavari-Krishna, Krishna-Pennar and Pennar-Cauvery have been finalized and once a consensus is reached among the beneficiary states, the Centre will provide support for implementation.

- The Finance Minister underlined that the Emergency Credit Line Guarantee Scheme (ECLGS) has provided much-needed additional credit to more than 130 lakh MSMEs to help them mitigate the adverse impact of the pandemic.

- Similarly, Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE) scheme will be revamped with required infusion of funds. This will facilitate additional credit of Rs 2 lakh crore for Micro and Small Enterprises and expand employment opportunities. She informed that Raising and Accelerating MSME Performance (RAMP) programme with outlay of Rs 6,000 crore over 5 years will be rolled out to make the MSME sector more resilient, competitive and efficient.

- Udyam, e-Shram, NCS and ASEEM portals will be interlinked and their scope will be widened.

- Dwelling on the subject of Skill development and Quality Education, the Finance Minister said that Startups will be promoted to facilitate ‘Drone Shakti’ through varied applications and for Drone-As-A-Service (DrAAS). In select ITIs, in all states, the required courses for skilling will be started.

- To impart supplementary teaching and to build a resilient mechanism for education delivery, the Finance Minister informed that ‘one class-one TV channel’ programme of PM eVIDYA will be expanded from 12 to 200 TV channels and this will enable all states to provide supplementary education in regional languages for classes 1-12.

- A Digital University will be established to provide access to students across the country for world-class quality universal education with personalised learning experience at their doorsteps.

- Under Ayushman Bharat Digital Mission, an open platform for the National Digital Health Ecosystem will be rolled out and it will consist of digital registries of health providers and health facilities, unique health identity, consent framework, and universal access to health facilities.

- The Finance Minister said, as the pandemic has accentuated mental health problems in people of all ages, a ‘National Tele Mental Health Programme’ will be launched for better access to quality mental health counselling and care services. This will include a network of 23 tele-mental health centres of excellence, with NIMHANS being the nodal centre and International Institute of Information Technology-Bangalore (IIITB) providing technology support.

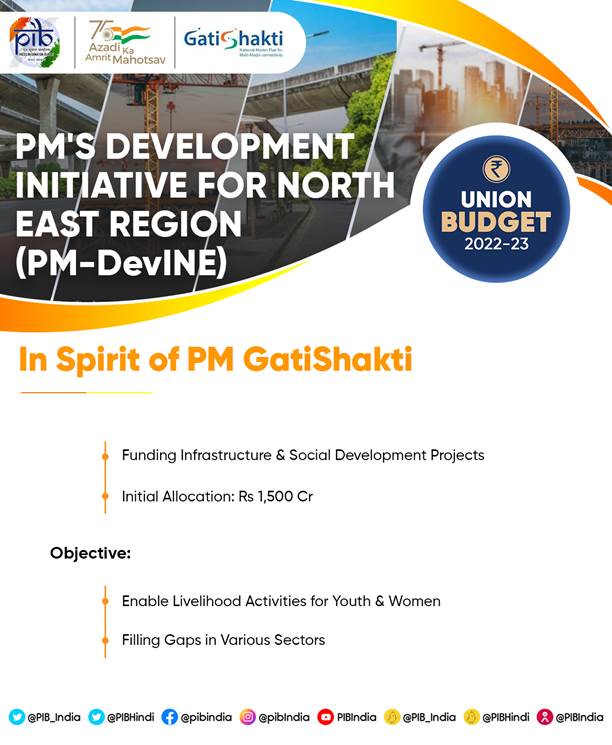

- A new scheme, Prime Minister’s Development Initiative for NorthEast, PM-DevINE, will be implemented through the North-Eastern Council to fund infrastructure, in the spirit of PM GatiShakti, and social development projects based on felt needs of the North-East.

- 100 per cent of 1.5 lakh post offices will come on the core banking system enabling financial inclusion and access to accounts through 11 net banking, mobile banking, ATMs, and also provide online transfer of funds between post office accounts and bank accounts.

- To mark 75 years of independence, the government has proposed to set up 75 Digital Banking Units (DBUs) in 75 districts of the country by Scheduled Commercial Banks to ensure that the benefits of digital banking reach every nook and corner of the country in a consumer-friendly manner.

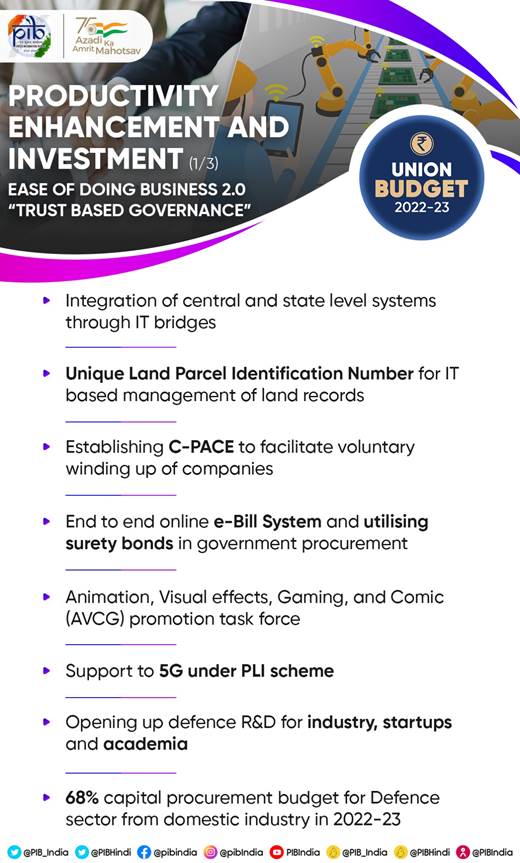

- The animation, visual effects, gaming, and comic (AVGC) sector offers immense potential to employ youth and therefore an AVGC promotion task force with all stakeholders will be set-up to recommend ways to realize this and build domestic capacity for serving our markets and the global demand.

- Telecommunication in general, and 5G technology in particular, can enable growth and offer job opportunities.

- Referring to Sunrise Opportunities, the Finance Minister said, Artificial Intelligence, Geospatial Systems and Drones, Semiconductor and its eco-system, Space Economy, Genomics and Pharmaceuticals, Green Energy, and Clean Mobility Systems have immense potential to assist sustainable development at scale and modernize the country. They provide employment opportunities for youth, and make Indian industry more efficient and competitive.

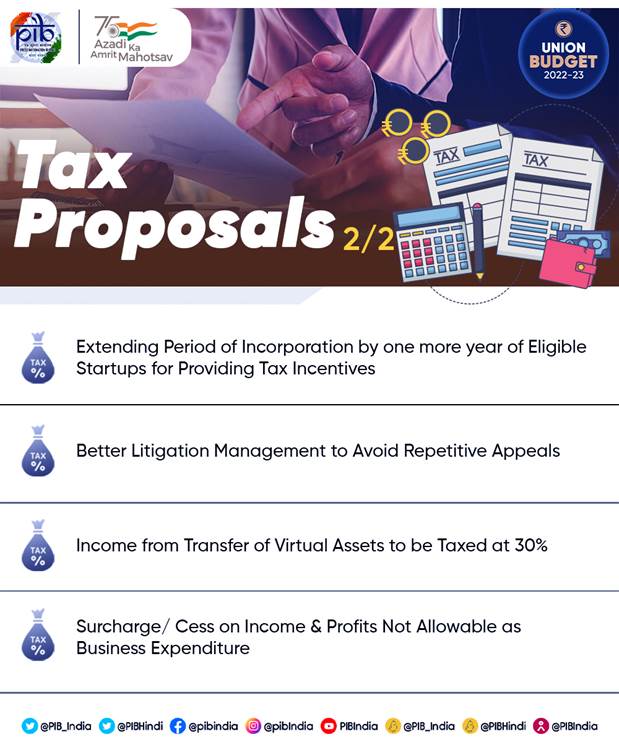

- The Government proposed to introduce Digital Rupee, using blockchain and other technologies, to be issued by the Reserve Bank of India starting 2022-23 for more efficient and cheaper currency management system.

- Reflecting the true spirit of cooperative federalism, the Central Government enhanced the outlay for the ‘Scheme for Financial Assistance to States for Capital Investment’

Union Budget 2022-23 Highlights : Download

Visit Abhiyan PEDIA (One of the Most Followed / Recommended) for UPSC Revisions: Click Here

IAS Abhiyan is now on Telegram: Click on the Below link to Join our Channels to stay Updated

IAS Abhiyan Official: Click Here to Join

For UPSC Mains Value Edition (Facts, Quotes, Best Practices, Case Studies): Click Here to Join