Context

-

The Reserve Bank of India (RBI) governor called the proposed 30% tax on gains from cryptocurrency exchanges a “threat to macroeconomic and financial stability” a week after the budget suggested it.

About Key Details

- The RBI Governor advised investors when announcing the bi-monthly monetary policy decision, citing the 17th century ‘tulip mania‘ as the first financial bubble.

- “Investors should keep in mind, that cryptocurrencies have no backing, not even a tulip”, said by RBI Governor.

- The central bank has always been opposed to private digital currencies.

- It had prohibited banks from assisting such transactions, however the Supreme Court revoked the ban in 2020.

Back to basics

About Tulip Mania

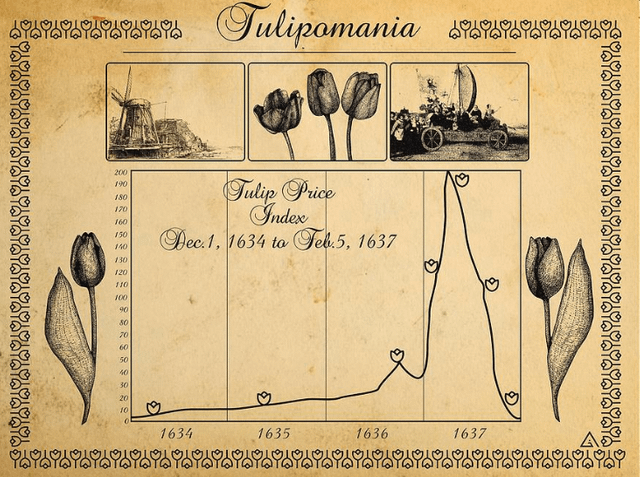

- The 17th-century ‘tulip mania’ is sometimes mentioned as a classic example of a financial bubble, in which the price of something rises not because of its intrinsic value but because of speculators looking to profit by selling a bulb of the exotic flower.

- It happened in Holland during the early to mid-1600s and is also known as the Dutch tulip market bubble. It was one of the most well-known stock market bubbles and crashes in history.

- Tulip bulbs rose in value as a result of speculation, and they were traded for a very high premium price.

- In today’s environment, it serves as a cautionary tale about the dangers of excessive speculation.

- The term “tulip mania” is used to characterize an economic bubble.

- People begin to invest in big amounts in a particular asset due to favorable perceptions of it.This causes the price of that asset to skyrocket.

- After hitting a peak, values plummet due to a large-scale sell-off, leaving asset owners bankrupt. Tulips are a metaphor for these assets.

Visit Abhiyan PEDIA (One of the Most Followed / Recommended) for UPSC Revisions: Click Here

IAS Abhiyan is now on Telegram: Click on the Below link to Join our Channels to stay Updated

IAS Abhiyan Official: Click Here to Join

For UPSC Mains Value Edition (Facts, Quotes, Best Practices, Case Studies): Click Here to Join