What are WPI and CPI inflation rates?

Context

-

Any inflation rate essentially tells us the rate at which prices have been rising in an economy. As such, an inflation rate is expressed as a percentage.

About inflation rates

- For every month, inflation rates are calculated both on a year-on-year basis — how prices have changed over the past year — as well as on a month-on-month basis — how prices have changed over the past month.

- Inflation rates are calculated for all commodities and commodity groups. So, we have inflation rates for onions as well as for all food items.

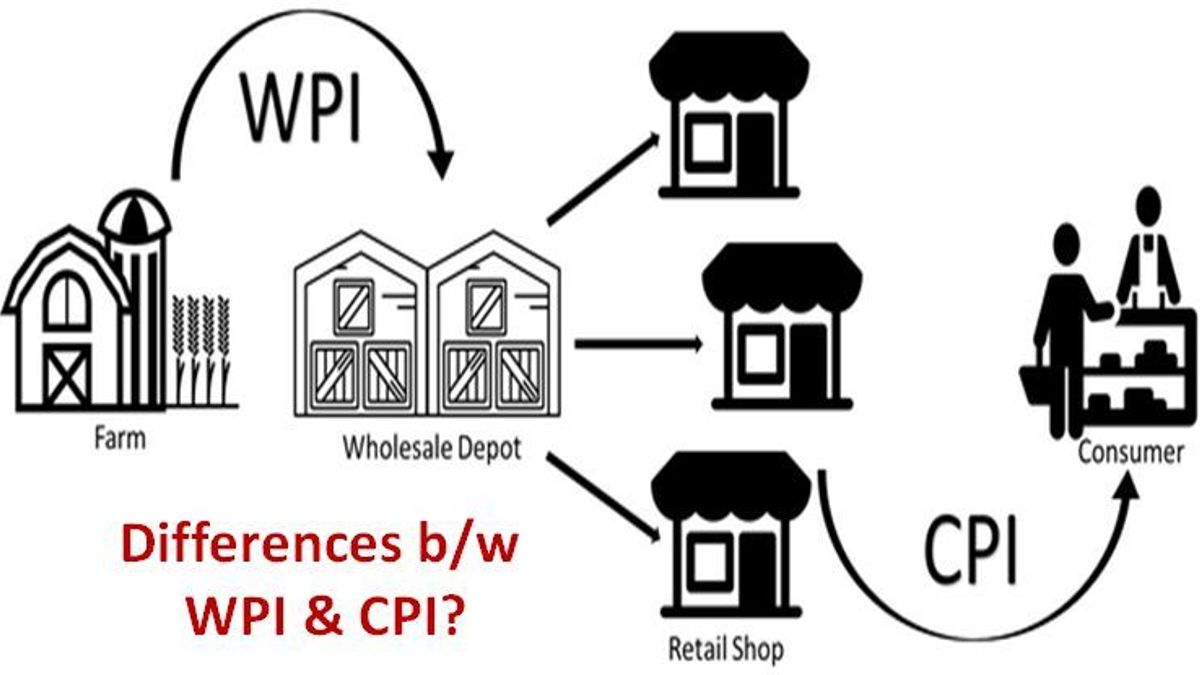

Pic Credit: Jagranjosh - But, the price of any commodity, say onions, also varies whether one buys the commodity in the wholesale market or whether one buys in the city mall.

- Comparing last year’s wholesale prices of onions with this year’s retail store prices will be misleading.

- So, the government comes out with two indices — one for mapping inflation in the wholesale market and one for mapping inflation in the retail market. Inflation rates are also calculated for rural and urban markets for better policy analysis.

About wholesale price index (WPI) and consumer price index (CPI)

- The two most-often used inflation rates in the country are the year-on-year

- the wholesale price index (WPI) based inflation rate and

- the consumer price index (CPI) based inflation rate

- The former is called the wholesale inflation rate and the latter is called the retail inflation rate.

- Both WPI and CPI are price indices.

- In other words, these are two different baskets of goods and services.

- The government assigns different weights to different goods and services based on what is relevant for those two types of consumers.

- The CPI-based inflation data is compiled by the Ministry of Statistics and Programme Implementation (or MoSPI) and the WPI-based inflation data is put together by the Department for Promotion of Industry and Internal Trade (or DPIIT).

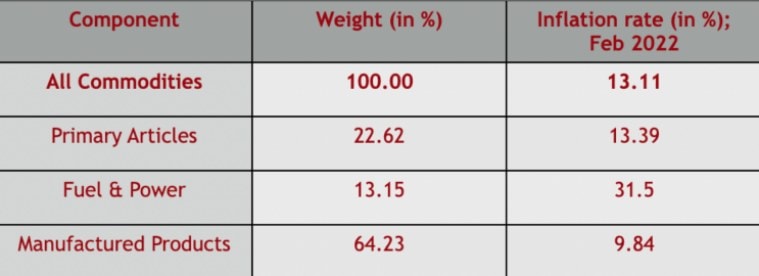

- For instance, the WPI is dominated by the prices of manufactured goods while the CPI is dominated by the prices of food articles. As such, broadly speaking, if food prices go up sharply, it will bump up the retail inflation rate far more than it would spike the wholesale inflation rate. The reverse will happen when prices of manufactured products (such as TVs and cars) rise sharply.

- A key difference that must not be missed is that the WPI does not take into account the change in prices of services — say a haircut or a banking transaction. But CPI does.

- If services such as transport, education, recreation and amusement, personal care etc. get significantly costlier, then retail inflation will rise but there will be no impact on wholesale price inflation.

- Since these two inflation rates are calculated based on two very different indices, it is not uncommon to find them at considerable variance with each other.

The two tables below bring out the differences.

Reference:

Visit Abhiyan PEDIA (One of the Most Followed / Recommended) for UPSC Revisions: Click Here

IAS Abhiyan is now on Telegram: Click on the Below link to Join our Channels to stay Updated

IAS Abhiyan Official: Click Here to Join

For UPSC Mains Value Edition (Facts, Quotes, Best Practices, Case Studies): Click Here to Join